Many or all of the products featured here are from our partners who compensate us. This may affect which companies we write about and where the company appears on a page. However, any analyses or reviews expressed in this article are those of the author alone and have not been approved or endorsed by any partner.

Pros

Cons

Credibly Business Loans Features

Credibly small business loans come in seven different varieties. The most popular option is a working capital loan, which operates a little differently than a standard term loan. Credit requirements are low, but you might find that rates and fees can be a little high on these products.

Rather than apply an interest rate, you’ll instead be charged a lump sum as a total percentage of the loan (known as a factor rate*), making it a little easier to budget for. For example, if you have a factor rate of 1.15 and you borrow $10,000, your total payment will be $11,500 over the life of the loan. Keep in mind you’ll be paying this back either weekly or daily, so make sure you’ve got the cash flow to cover it.

Editor's Note: To determine the total cost of financing, multiply the factor rate by the total loan amount. Also, please take note that factor rates due tend to convert to high APRs, so make sure you know the total cost of your loan before signing.

Working Capital Loan

For short-term lending needs Credibly offers a working capital loan. Working capital loans are a good option whenever you need to tap into funds to keep your regular business operations running, to buy equipment or material, or to cover other costs like payroll if money is tight.

| Term length | 6 to 18 months |

| Repayment period | Daily or weekly |

| APR range | Factor rates from 1.09 |

| Min - Max amount | Up to $400,000 |

Long-Term Business Expansion Loan

These convenient and flexible loans are offered over a longer period of time and usually have lower rates. They’re used specifically for business expansion, so you’ll need to include a business plan as part of your application. Plus, it’s unlikely newer businesses will qualify and you’ll need to have a little experience under your belt.

| Term length | 18 to 24 months |

| Repayment period | Monthly |

| APR range | Between 8% - 25% |

| Min - Max amount | Up to $250,000 |

Line of Credit

A business line of credit is a flexible type of lending that allows you to draw on a designated lending limit. You only pay interest on the money you use, although you will be charged fees every time you dip into it.

| Term length | Some are open-ended |

| Repayment period | Monthly payments on amount used |

| APR range | From 4.8% |

| Min - Max amount | Up to $250,000 |

SBA Loans

Backed by the government, an SBA loan has more favorable terms and lower APRs, but will often require more documentation to apply. SBA loans typically have a slower funding time, too, so if you need the funds now, this may not be the best option for you.

| Term length | 2 - 25 years |

| Repayment period | Monthly |

| APR range | Starting from 6.99% |

| Min - Max amount | Not disclosed |

Merchant Cash Advance

With merchant cash advance, you’re promising to repay a percentage of your credit and debit card sales. Terms are usually short-term and interest rates are higher, but low credit scores are accepted and funding typically takes just 48 hours.

| Term length | 3 - 18 months |

| Repayment period | Daily |

| APR range | Factor rates from 1.09 |

| Min - Max amount | Up to $400,000 |

Equipment Financing

Equipment financing is used to purchase a specific item of machinery that will be used as collateral for the loan. Since the equipment acts as collateral, rates are typically lower and terms are more flexible.

| Term length | The working life of the asset |

| Repayment period | Monthly |

| APR range | Not disclosed |

| Min - Max amount | $10,000 - $10M* |

Some products given through Credibly’s network for external funding partners

Invoice Factoring

Invoice factoring allows you to sell your invoices at a discounted rate in exchange for cash. You can then use the cash to grow your business, pay employees, or purchase inventory. Rather than wait for your customers to pay you, Credibly can provide you with the funds you need within 48 hours.

| Term length | Usually one month |

| Repayment period | When you receive payment from your customers |

| APR range | Not disclosed |

| Min - Max amount | Up to $400,000 |

Credibly Interest Rates and Fees

With so many Credibly small business loans available, you’ll find a wide range of rates and fees. Generally, an origination fee of 2.5% will be charged regardless of the type of borrowing you choose, while other fees can vary. The platform doesn’t disclose all charges before you apply, so you may want to get in touch directly to learn more.

| Origination fees | 2.5% |

| Prepayment fees | None |

| Late payment fees | Not disclosed |

| Maintenance fees | Not disclosed |

| Interest rates | Factor rates as low as 1.09 |

How to Qualify for a Credibly Business Loan

Qualification criteria are quite lenient, especially when compared to other online lenders. The lowest credit score accepted is 500, and you’ll need an average of $15,000 per month in gross sales and to have been in business for at least six months. However, there are some slight variations for each loan type that we’ve outlined below.

| Working Capital | Line of Credit | SBA Loans | Merchant Cash Advance | Other Loans | |

| Minimum credit score | 500+ | 560+ | 620+ | 500+ | Not disclosed |

| Minimum annual revenue | $180,000 | $50,000 | Not disclosed | $180,000 | Not disclosed |

| Minimum time in business | Six months | Six months | Two years | Six months | Not disclosed |

Credibly Loan Application Process

Credibly’s seamless loan application process allows you to get approved within four hours. If approved, funding can take place that same day.

Credibly offers a pre-qualification process via a soft-pull credit inquiry. This is ideal for borrowers because they’re able to find out if they’re eligible for a financial product without impacting their credit rating.

Let's walk through the process step-by-step.

1. Provide Basic Personal Information

Fill out your name, email, and phone number.

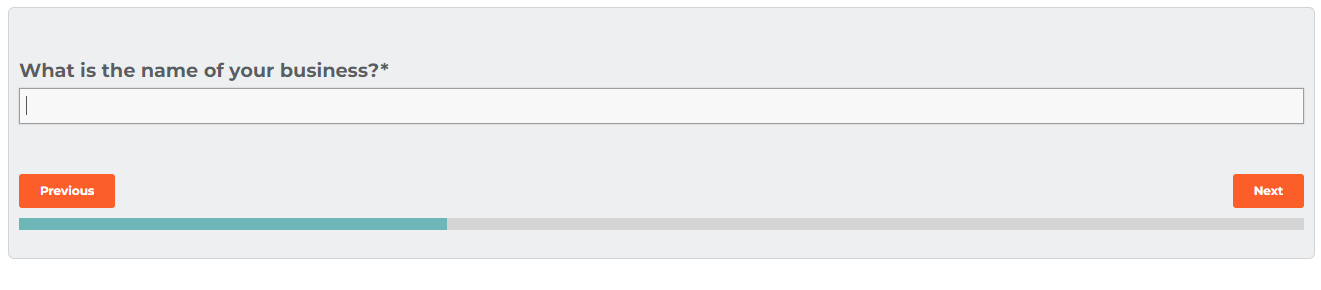

2. Provide Your Business Information

Fill out the name of your business, how long has your business been generating revenue, whether you deposit into a business bank account, your average monthly revenue, and the industry you're in.

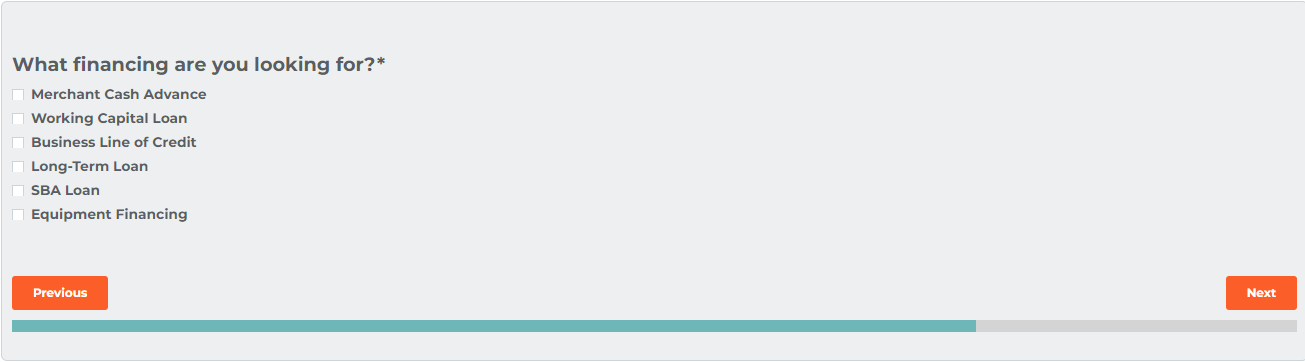

3. Choose the Loan Type

Credibly offers seven different loan types, choose the loan that best meets your business needs.

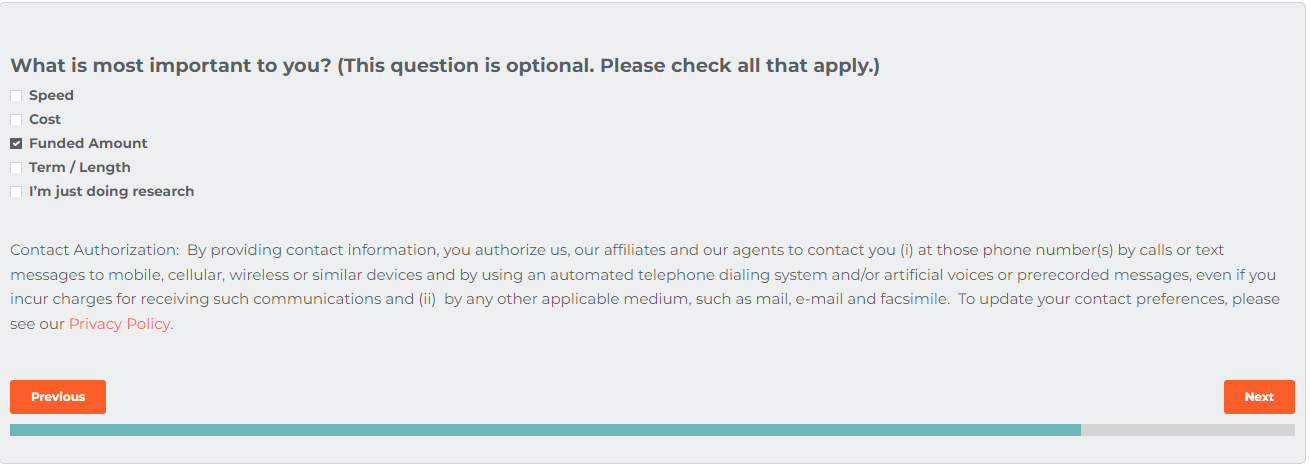

4. Choose What is Most Important For You in a Business Loan Application

5. Talk to a Financing Representative

After submitting your online pre-qualification request, one of Credibly's financing representatives will contact you through phone call or email to follow up, and walk you through next steps.

At this point, the following documentation should be collected and submitted:

- At least three years worth of tax returns

- Three months of bank statements

- A well-developed business plan

- An understanding of what will be collateral for the loan

- Proof of monthly revenue

- The amount you would like to request in loan funds

Future borrowers should also spend time cleaning up any credit related issues that may be dragging down their score, as the higher the score, the better the loan terms and likelihood of approval. Credibly notes that approvals are quick; however, like all loan requests, there are various factors that influence the speed of a loan request. Once approved, funds may be made available to borrowers that same day.

How Does Credibly Determine the Loan Amount?

Your loan amount will primarily be decided by your credit score. Although, your business performance and profit and loss statement will play a key role, too. Beyond this, Credibly doesn’t give much away about its assessment method, so you might want to get in touch directly if you have questions.

Credibly Customer Support

Credibly is praised across the board for its excellent customer service. You can reach out over the phone, email, or live chat via the website. What’s more, the lender is active across multiple social media accounts and inquiries are encouraged.

Plus, you’ll find a range of blogs and guides on the website covering topics like debt refinancing, dealing with poor credit and asset-based lending.

Credibly Perks and Bonuses

While some financial institutions opt to focus on servicing a small number of financial products and services, Credibly’s unique strength as a lender is in its variety of products, quick access to funding, and U.S.-based customer service team that allows customers to address their questions and issues without dealing with a huge time difference.

Flexibility

Credibly offers reasonable lending terms for specific products and borrowers are able to make modification requests, though it’s unclear as to how often those requests are approved.

Transparency

The Credibly website provides an incredibly wide range of resources that assist and educate potential borrowers on what to expect when making a borrowing request.

Trustpilot Credibly reviews show a consistently high level of customer satisfaction, with customers reporting they were happy with the service and pleased with how quickly funding was received.

Other customers reported some frustration related to communicating with Credibly when they have pressing questions about their loan processing. This was an infrequently reported frustration.

Technology

Customers use an online portal to access all details of their customer profile. Customers can also use the chat feature to answer quick questions, email, or call Credibly customer support. Credibly doesn’t have an app to support its platform at this time.

Credibly users set up ACH payments within the customer portal. Borrowers should be mindful of the different payment cadences available to them ranging from daily repayments to weekly.

Alternatives to Credibly

National Funding

National Funding offers both small business loans and equipment financing and leasing. Small business loans range from $5,000 to $500,000 and funds can be available within 24 hours of loan approval. Equipment financing and leasing loans are for new or used equipment, and can be given up to $150,000.

Applying for a loan from National Funding is easy and it won’t affect your credit score. You’ll be matched with a Funding Specialist to guide you along the way, and decisions and funding times are quick. The company doesn’t have set requirements to qualify, but we do recommend a credit score of at least 550 and a business history of six months or more to increase your chances of approval.

Learn more in our National Funding review

Final Thoughts

Unlike other lenders that have a smaller suite of financial products, Credibly offers an impressive range of financial products - including working capital loans, small business lines of credit, long-term business loans, and SBA loans. Credibly is able to take care of most company’s borrowing needs regardless of the business stage.