Many or all of the products featured here are from our partners who compensate us. This may affect which companies we write about and where the company appears on a page. However, any analyses or reviews expressed in this article are those of the author alone and have not been approved or endorsed by any partner.

Pros

Cons

Bluevine Line of Credit Features

A business line of credit is an unsecured, flexible small business loan that you can access as needed with interest charged when the money is borrowed. Businesses typically use lines of credit to cover gaps in revenue, to finance new projects, or to purchase inventory. In order to qualify, you must have a minimum credit score of 625.

| Term Length | 6 or 12 months |

| Repayment Period | Weekly and monthly |

| Min-Max Amount | $5,000 to $250,000 |

Bluevine Interest Rates and Fees

Bluevine offers monthly or weekly repayment options for their lines of credit, with a six or 12 month payback period. Since repayments are calculated daily using simple interest, you save money by paying early. There are no penalties for paying early.

Below are the following fees you can expect with a Bluevine line of credit:

| Origination Fees | None |

| Prepayment Fees | None |

| Late Payment Fees | Up to 5% of missed repayment plus the interest that has accrued |

| Maintenance Fees | None |

| Interest Rates | 0.30%-1.50% per week (Flex6) 1.50%-6.50% per month (Flex12) |

How to Qualify for Bluevine Loan

During the application process, your business will be evaluated to determine the likelihood you can pay back the loan. Certain industries are not eligible for lines of credit, including gambling, political campaigns, auto sales, firearms, financial institutions, and nonprofits. In addition, North and South Dakota businesses are not eligible for lines of credit with Bluevine.

- Credit History: 625+ FICO score

- Time in Business: 6+ months in business

- Monthly Revenue: $10,000 a month in revenue

Bluevine Loan Application Process

The Bluevine loan application process is incredibly simple, and can be completed in as little as five minutes. Below, Gordon Scott walks us through the step-by-step process.

1. Soft Credit Check

First, Bluevine performs a soft credit pull. This means that they check your credit through an independent party, which gives them enough information to make sure you qualify without hurting your credit score.

Note: Soft credit pulls can add up if you shop around, and they may temporarily have a minimum effect on your credit score.

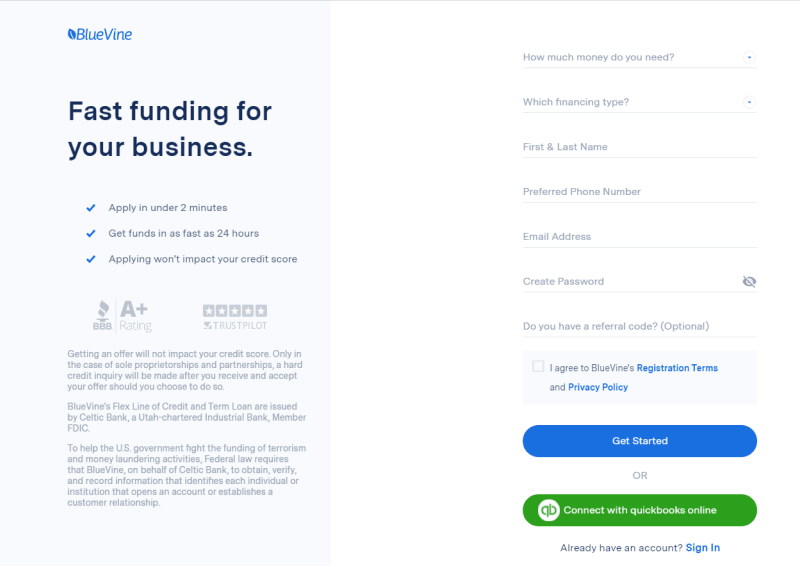

2. Fill Out the Application Form

The questions you would need to answer are very simple, including:

- Amount of money required

- Preferred financing type

- Identification information

You’ll also need to provide a few documents, such as:

- Two to three months of bank statements

- Two years of personal tax returns

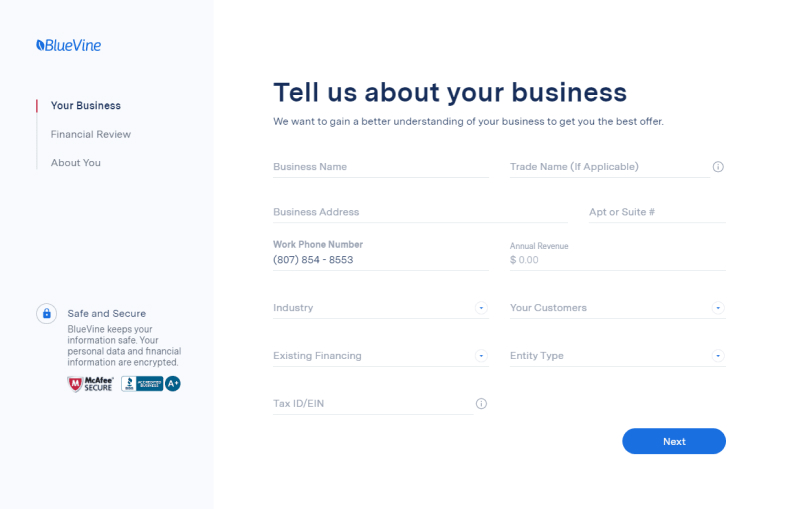

When filling out the application form, make sure to read the fine print so that you don’t miss any important details. You will then be asked to share some details about your business. The answers you provide to the questions in the application form will determine what additional information you will be asked for.

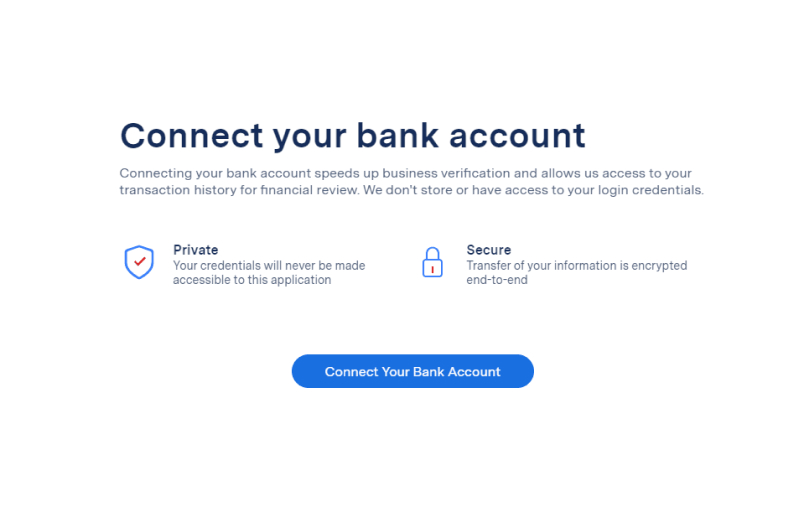

3. Connect Your Bank Account

Once you fill out all the required fields, you will be asked to connect your bank account. If you are approved for the loan, the funds will be electronically transferred into your account in as little as 24 to 48 hours.

4. Pay Back the Loan

Each draw on your line of credit is paid back with fixed monthly or weekly payments over six or 12 months. When the time comes to make your payment, Bluevine will automatically take it out of your bank account. While this is very convenient, it means that the lender can take the money out on their own terms. You need to keep track of your payment schedule in order to be prepared for automatic payments.

5. Continually Access More Funds

As you pay off your balance, your funds are replenished and you’re able to use that money again. This is similar to how a credit card works in that it’s a revolving line of credit. Use as needed, pay it off, use again as needed, and so on and so forth.

Bluevine Customer Support

Bluevine’s customer service is highly rated and regarded. You can get in touch with the customer care support team from morning (8 am ET) to evening (8 pm ET) Monday through Friday. Customers can reach representatives through their website contact page, as well as through Facebook and Twitter for less formal interactions

Bluevine’s customer service representatives are very responsive regardless of the contact method you choose. Additional help is also available on Bluevine’s FAQ page.

Bluevine is highly rated for its transparency and you can find additional information in their resources section, including a FAQ page, a help center, a list of partners, and a business blog that covers a variety of relevant topics.

Perks and Bonuses

Bluevine’s primary focus is working with the financial needs of small businesses. Perks and bonuses of securing a loan with Bluevine include:

Flexibility

Customers may repay their lines of credit via check, credit card or ACH transfers. Once approved, Bluevine funds are available upon demand. Qualified borrowers can gain access to credit limits up to a maximum of $250,000. The credit limit terms are a maximum of 12 months.

Transparency

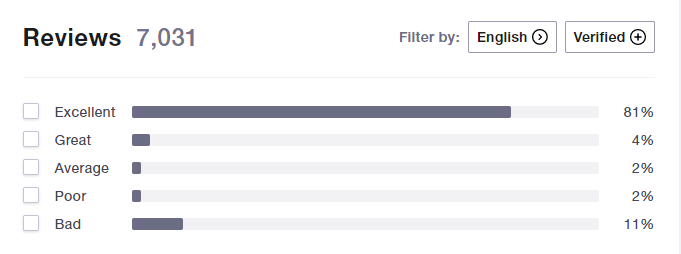

Bluevine’s website is easy to navigate and Trustpilot reviews for Bluevine are outstanding, with customers reporting high levels of satisfaction with the application process and funding experience. Bluevine clearly states what you need to qualify, what you can expect as far as repayment terms, and how to make the most of your Bluevine line of credit.

Technology

Customers are able to access their account information via the online portal, Bluevine app or ATM by using the Bluevine Business Debit Mastercard. Borrowers may also opt to pay on their line of credit via autopay or by setting up recurring online payments.

Bluevine Alternatives

Fundbox

Fundbox offers small business loans and lines of credit up to $150,000. The requirements are similar to Bluevine’s, with the exception being credit score. To qualify for funding from Fundbox, you need a minimum credit score of 600, as opposed to Bluevine’s minimum of 625.

Fundbox lines of credit terms are 12 or 24 weeks, with rates starting at 4.66% for 12-week terms. Term loans, on the other hand, are paid back over 24 or 52 weeks, with rates starting at 8.33% for 24-week terms. Applying takes just a few minutes, and funds can be in your account as soon as the next business day.

Learn more in our Fundbox vs Bluevine review.

Additional Alternatives

| Lender | Loan Amount | Interest Rates | Min. time in business | Min. Revenue |

| Credibly | Up to $400K | Starting at 6.99% | 2 years | $100K |

| Biz2Credit | $25K - $6 million | Starting at 7.99% | 6 months | $250K |

| OnDeck | $6k - $250K | Varies | 1 year | $100,000 |